unrealized capital gains tax meaning

As a result there is the possibility that the paper gain might be erased if the price goes back down. Why is this important.

The asset doesnt have to be an investment in stocks or bonds or Bitcoin.

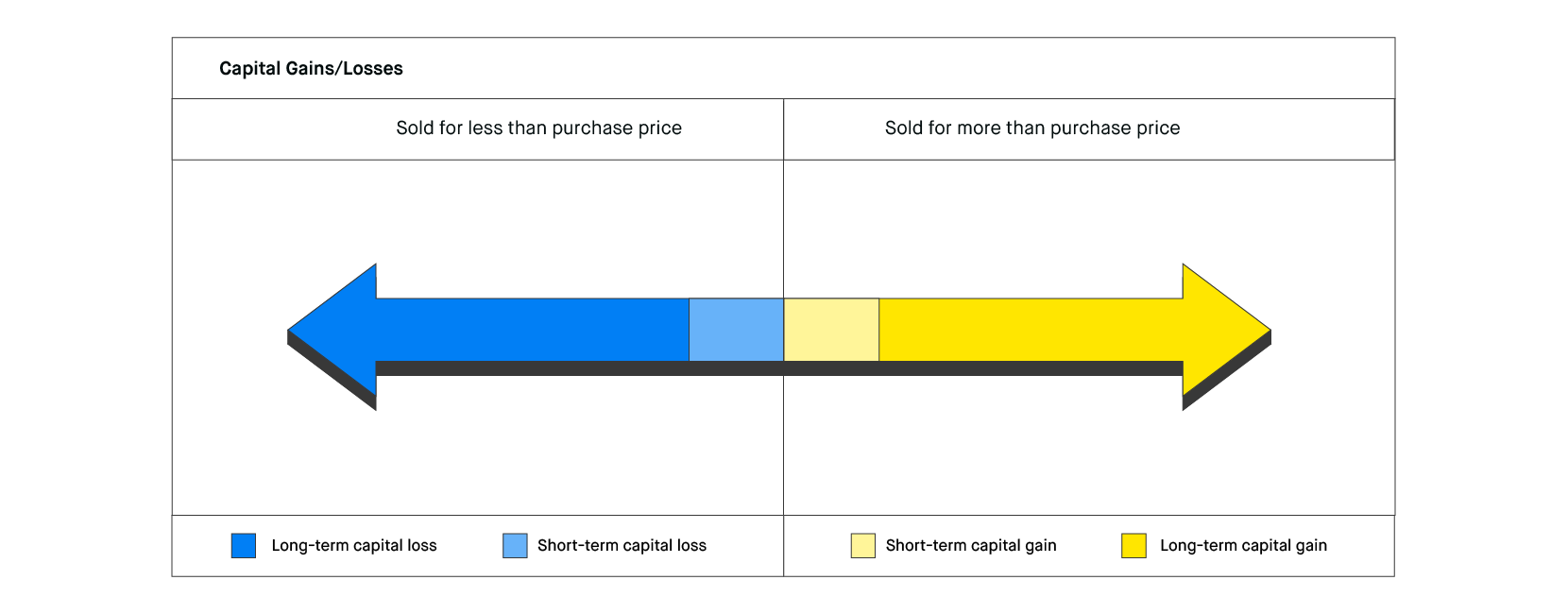

. The capital gains tax only applies to realized capital gains. Not to insult anyones intelligence but unrealized capital gains are those youve made on an asset you havent sold yet. Capital gains are taxed only when they are realized while capital losses are deducted only when they are realized.

Under the current tax code unrealized capital gains are not considered income by the IRS so theyre not taxed. A gain on an investment that has not yet been realized. If you dont sell the asset you have an unrealized capital gain which isnt subject to taxes.

This means that if you own stocks or real estate that are increasing in value youre not required to pay taxes on them until you sell them. Realizations would fall so much that it would more than offset the revenue produced by the higher tax rate. That is a paper gain occurs when the current price of a security is higher than the price the holder paid for it but the holder still owns the security.

But just because you see. The most likely impact that they will have on. Unrealized gains are not taxed by the IRS.

A capital gain is an increase in the value of an asset while a loss refers to the loss of value. Its normal to see the investments in your portfolio going up and down in value over time. Not able to change.

As a result there is the possibility that the paper gain might be erased if the price goes back down. It could be some property you own or the house you live in. Realized capital gains occur on the date of exit as this triggers a taxable event whereas unrealized capital gains are simply paper gainslosses.

Without taxing unrealized gains at death the revenue-maximizing capital gains tax rate is about 30 percent in the long run and about 20 percent in the short run. Realized gains and losses occur when you actually sell or dispose of the asset. Such a tax is really a tax on wealth.

So now that you understand what unrealized gains are how do they impact your life. The IRS treats short-term and long-term Capital Gains differently but the point is that in order to be taxed on Capital Gains the gain has to be realized. Houses Are Subject to Capital Gains Tax Just Like Stocks.

Capital gains are only taxed if they are realized which means you dispose of the asset. Unrealized Capital Gain means with respect to any Reference Obligation if the Current Price of such Reference Obligation is greater than the Initial Price in relation to such Reference Obligation then a such Current Price minus such Initial Price multiplied by b the Reference Amount of such Reference Obligation. In reality it is a tax on wealth.

Capital gains meaning earnings from selling an asset for more than you bought it are taxable under federal tax law. That is a paper gain occurs when the current price of a security is higher than the price the holder paid for it but the holder still owns the security. Realized Gains Actual locked-in gains.

For example if you buy a house for 200000 and the value goes up to 210000 your basis is 200000 and you have a 10000 unrealized gain. A gain or a loss becomes realized when you sell the investment. This means you dont have to report them on your annual tax return.

Unrealized gains and losses. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. Unrealized Gains Current snapshot in time.

Unrealized gains also referred to as paper gains are NOT taxable. Since you wont pay taxes on what you lost or something that you havent earned yet the unrealized gains tax doesnt really apply to your federal income tax return until they are realized. A gain on an investment that has not yet been realized.

Capital gains and losses can be realized or unrealized. When you hear Yellen and other Democrats talk about unrealized Capital Gains they are talking about taxing you on the appreciation of your stocks or properties even. Taxing unrealized capital gains at death theoretically increases the revenue-maximizing capital.

The distinction between unrealized and realized gainslosses is an important one because there are tax implications that could impact your tax bill at the end of the year. What is an unrealized capital gains tax. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax.

They only exist on paper. And the unrealized losses arent deductible. In other words the unrealized gains you have for the tax year arent taxable.

An investor is NOT taxed until the investment is exited and a profit is obtained. Unrealized losses occur when an investment you hold has lost money but you. Unrealized Capital Gains means the excess of the fair market value of the Alabama Trust Fund on the last day of the fiscal year over the fair market value of the Trust Fund on the last day of the immediately preceding fiscal year.

It has to be real. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

The Unintended Consequences Of Taxing Unrealized Capital Gains

What Are Capital Gains Robinhood

The Unintended Consequences Of Taxing Unrealized Capital Gains

How Capital Gains Affect Your Taxes H R Block

Capital Gain Formula And Taxes On Unrealized Realized Gains

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

What Are Capital Gains Robinhood

Spot And Forward Interest Rate In 2022 Interest Rates Accounting Books Financial Management

Many Users Are Confused When They Try To Report Their Backdoor Roth In Turbotax This Article Gives Detailed Step By Step Inst Turbotax Roth Federal Income Tax

I Chose This Image To Represent Management Operating Agreements This Image Displays That An External Management Compan Management Company Incentive Management

An Unrealized Capital Gains Tax Would Wallop Big Stock And Bitcoin Investors Nasdaq

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Crypto Tax Unrealized Gains Explained Koinly

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)